When it comes to securing a mortgage, a key factor that lenders consider when evaluating a borrower’s lending capacity is Loan-to-Value (LTV) ratio. Understanding mortgage LTV, how it’s calculated, and how it can impact your mortgage can help you make informed decisions during the homebuying process. Let’s dive into the details of LTV ratios and why they matter.

What Is Loan-to-Value (LTV) Ratio?

The LTV ratio is a financial term used by lenders to assess the risk of a loan. It compares the loan amount to the appraised value of the property being purchased or refinanced.* The LTV ratio is expressed as a percentage, demonstrating how much of the property’s value is being financed through the mortgage.

*By refinancing an existing loan, total finance charges may be higher over the life of the loan.

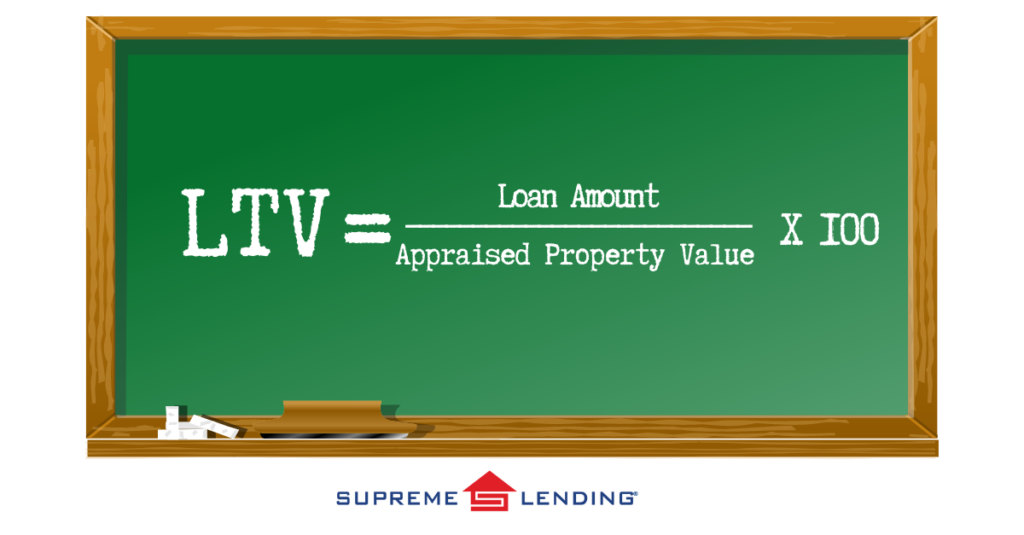

How Is Mortgage LTV Calculated?

The LTV ratio is calculated using the following formula:

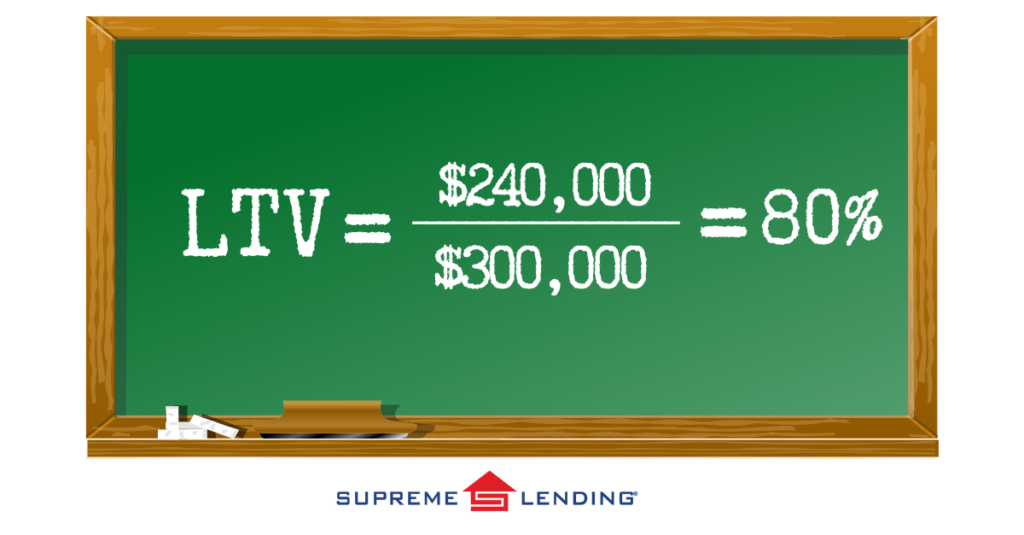

For example, if you’re purchasing a home with an appraised value of $300,000, and you’re borrowing $240,000, the mortgage LTV would be 80%:

How LTV Relates to Mortgage and Homebuying

LTV ratios play a crucial role in the mortgage approval process. Lenders use LTV to determine the level of risk associated with a loan. A lower LTV signifies lower risk, as the borrower has more equity in the property. Consequently, a higher LTV indicates higher risk for the lender, as the borrower has less equity.

How to Measure Mortgage LTV Ratios

A fair LTV ratio is typically 80% or lower. An LTV ratio of 80% or less is favorable because it often means the borrower is not required to pay for private mortgage insurance (PMI), which is usually mandatory for higher LTV ratios. PMI protects the lender in case of default but adds extra cost for the borrower.

LTV Requirements by Common Loan Types

Loan-to-Value criteria depends on the type of loan. Here’s a breakdown of common LTV limits to keep in mind:

- Conventional Loans:

- Maximum LTV: 80% to avoid PMI

- With PMI: Up to 97%

- FHA Loans:

- Maximum LTV: 96.5% for borrowers with a credit score of 580+

- VA Loans:

- Maximum LTV: 100% (no down payment required for eligible Veterans)

- USDA Loans:

- Maximum LTV: 100% (no down payment required for eligible rural properties)

Frequently Asked Questions About LTV Ratios

How Can I Lower My LTV?

You can lower your LTV ratio by making a larger down payment or by choosing a less expensive property relative to the loan amount.

Does a High LTV Affect the Mortgage Interest Rate?

Yes, a higher LTV ratio may result in higher rates because it can be seen as a higher risk for the lender. On the other hand, a lower LTV may qualify for lower rates.

What If My LTV is Above 80%?

If your LTV ratio is more than 80%, you may be required to pay mortgage insurance. This adds protection for the lender and an additional cost to the monthly mortgage payment.

Can LTV Ratios Change?

Yes, Loan-to-Value ratios can change over time as you pay down your loan and as the value of your property increases.

Understanding mortgage LTV is important to making informed decisions about your home financing. By knowing how your Loan-to-Value is calculated and its impact toward your mortgage, you can better navigate the homebuying process and know what to expect.

Our experienced and knowledgeable team at Supreme Lending is committed to helping you achieve your dream of homeownership with confidence and ease. Contact us today to learn more about your loan options and get pre-qualified today.

Related article: Mortgage DTI: What Is Debt-to-Income Ratio?