The Ultimate Mortgage DTI Handbook

When it comes to securing a mortgage, understanding your finances has never been more important. One of the most important metrics lenders use when evaluating a borrower’s eligibility for a mortgage is Debt-to-Income ratio, commonly known as DTI. Let’s dive into what exactly mortgage DTI is, how it’s used, what sources of debt and income are considered, and what establishes a fair or good DTI. Plus, we’ll offer some helpful tips for potential homebuyers on understanding their DTI.

What Is Debt-to-Income (DTI) Ratio?

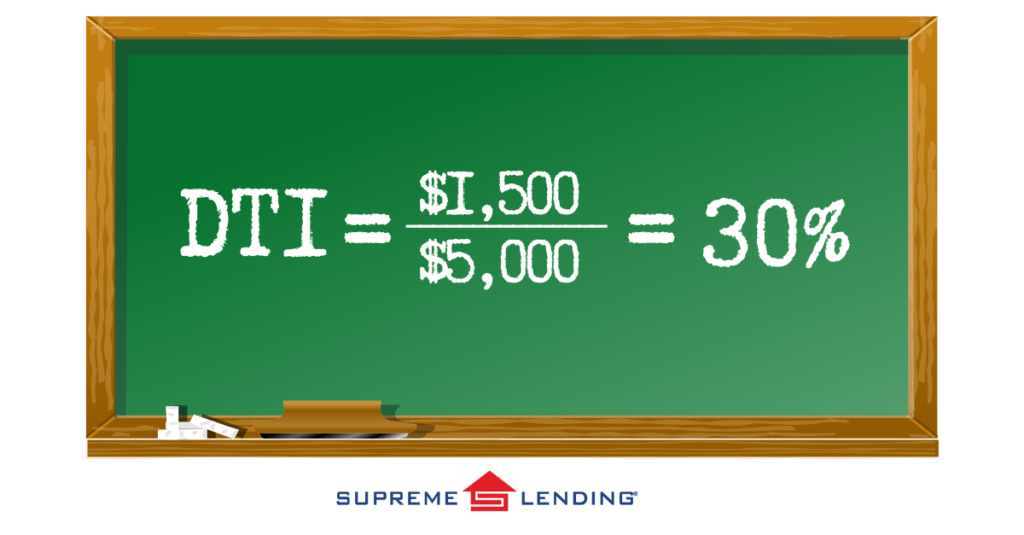

DTI is a financing metric that compares an individual’s monthly debt payments to their gross monthly income. Essentially, it measures the percentage of your income that goes toward paying off debts. Lenders use DTI to assess a borrower’s ability to make monthly payments to repay the loan. DTI is calculated by dividing your total monthly debt payments by your gross monthly income and multiplying the result by 100 to get the ratio percentage.

For example, if you have $1,500 in monthly debt payments and a gross monthly income of $5,000, your DTI would be 30%, as calculated below:

How DTI Is Used to Determine Mortgage Eligibility

Lenders look at your DTI to evaluate your ability to take on additional debt in the form of a mortgage. A lower DTI indicates that you have a good balance between debt and income, resulting in a more attractive and capable buyer. There are DTI thresholds that borrowers will need to meet, which can vary by lender or specified by the loan program guidelines.

Types of Mortgage DTI

- Front-end DTI: Also called a housing ratio or mortgage-to-income, this ratio only calculates housing-related expenses, such as the monthly mortgage payment, property taxes, homeowners’ insurance premiums, and homeowners association fees, if applicable, relative to your gross monthly income.

- Back-end DTI: This ratio includes all your monthly debt obligations, such as credit card payments, car loan payments, and student loan debt, in addition to the housing-related debt. Lenders typically focus more on back-end DTI when evaluating a buyer’s capability to repay a loan as it provides a clearer picture of their financial responsibilities.

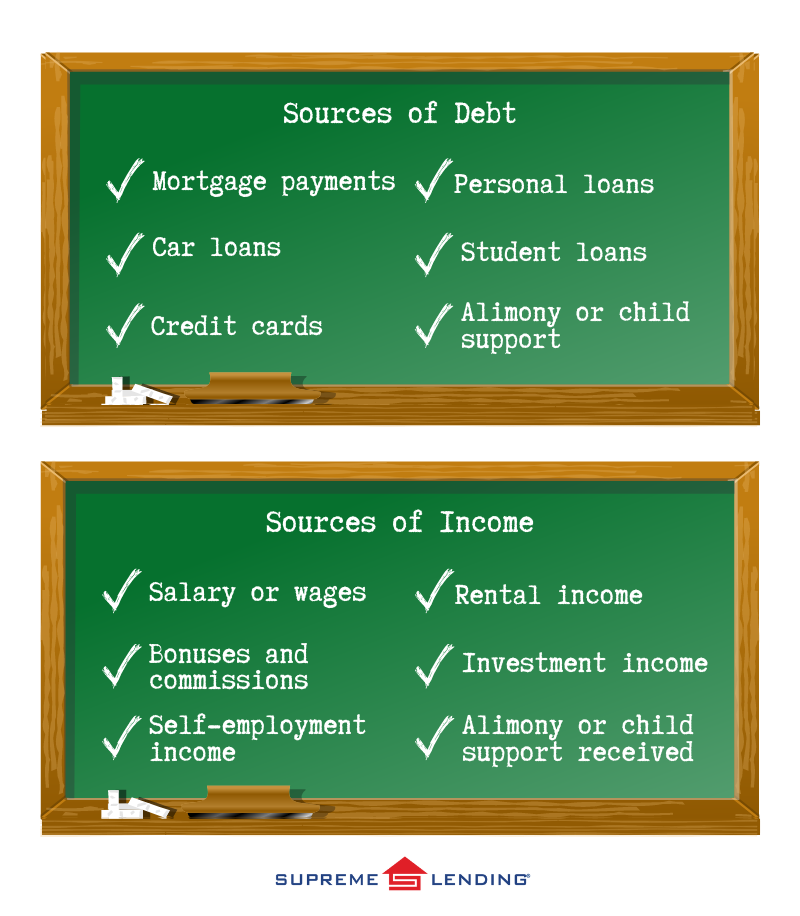

Sources of Debt and Income Considered

What Is Considered a Favorable DTI?

A good DTI ratio for a mortgage depends on the type of loan and the lender. Most lenders prefer a back-end DTI of around 36% or less, though some may accept higher ratios, especially for borrowers with strong credit scores or significant assets.

Helpful Mortgage DTI Tips for Potential Homebuyers

1. Avoid New Debt

Before applying for a mortgage, calculate your current DTI to give you a rough understanding of where you stand. This will help identify if you need to make any adjustments to potentially improve your DTI ratio before deciding to purchase a home.

2. Reduce Outstanding Debts

Paying down existing debts can significantly improve your DTI. Consider focusing on reducing or eliminating higher interest debts like credit card balances first.

3. Increase Your Income

Look for opportunities to boost your income. This could be through a salary increase, getting a higher-paying job, adding a part-time gig, or exploring other income sources.

4. Avoid New Debt

Refrain from taking on new debt before applying for a mortgage and during the loan approval process. New loans or credit lines may have an impact on your DTI and mortgage eligibility.

5. Seek Professional Advice

Consult with a financial professional for personalized guidance or a loan officer to get a better understanding of your DTI and loan program requirements. There may be other mortgage options better suited for you depending on your goals, such as Debt Service Coverage Ratio (DSCR) loans for investment properties that don’t use DTI.

6. Consider a Co-Signer

If your DTI is in the higher range, you may benefit from having a co-signer who has a higher income or less debt to contribute.

7. Understand Loan Programs

Guidelines and criteria to qualify for a mortgage vary depending on the program and lender. For example, FHA loans typically have more lenient DTI requirements than Conventional loans. Work with our team at Supreme Lending to explore a variety of different mortgage options and find the one best fit for you.

Managing Your Debt-to-Income Ratio

Understanding mortgage DTI and your Debt-to-Income ratio is essential for navigating the loan process. By managing your DTI and making informed decisions, you may potentially improve your mortgage eligibility and chances of securing your dream home.

Contact Supreme Lending to learn more about how we can help you achieve your homeownership goals with confidence.