An Investor’s Guide for DSCR loans

Whether you’re just getting started with your investment portfolio or are a seasoned investor, navigating real estate is all about strategy. Supreme Lending is proud to offer a program to help investors easily finance dream investment homes without a traditional mortgage: the Debt Service Coverage Ratio (DSCR) loan. Here’s a guide for everything you need to know about DSCR loans, how they work, and the benefits they offer for investors looking to maximize returns.

DSCR Loan Basics

Simply put, DSCR is the ratio of a property’s rental income to its mortgage payment, taxes, and insurance. This helps lenders measure an investor’s ability to cover the mortgage from the cash flow generated from the property.

DSCR is similar to Debt-to-Income (DTI) for typical mortgages. However, the difference is that for a traditional loan, the percentage to service the debt is dependent on the borrower’s personal income, whereas for income-producing properties, it’s based on the property’s income. No income or employee verification is needed.

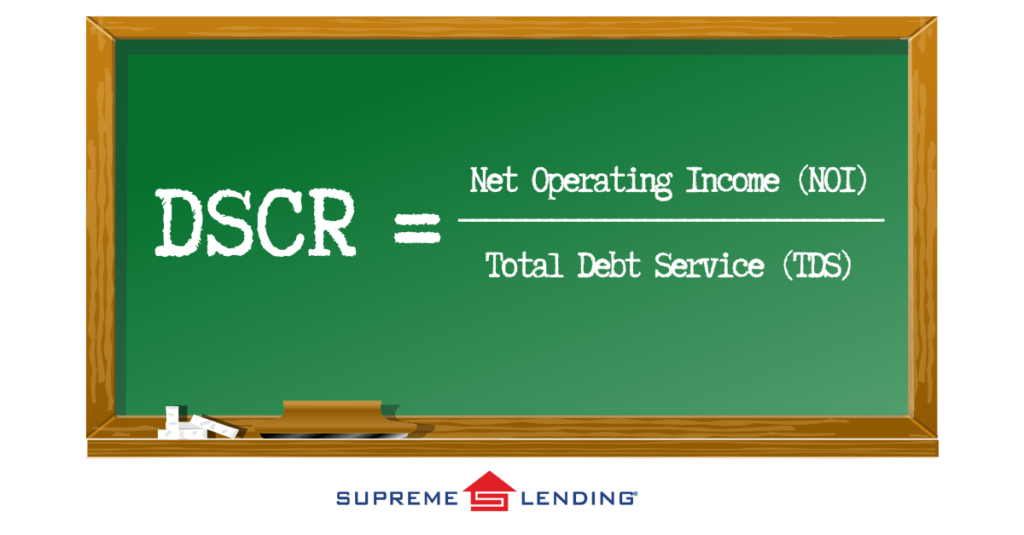

How To Calculate DSCR

To calculate the DSCR, divide the property’s net operating income (NOI) by its total debt service (TDS). The formula is as follows:

A DSCR of 1.0 indicates that the property’s net operating income is exactly equal to its debt obligations. A DSCR greater than 1.0 signifies that the property generates more income than needed to cover its debt payments, while a DSCR below 1.0 indicates insufficient income to cover debt payments. Typically, rates of 1.25 or greater are ideal and borrowers may receive better pricing with a higher ratio.

Eligibility for DSCR Loans

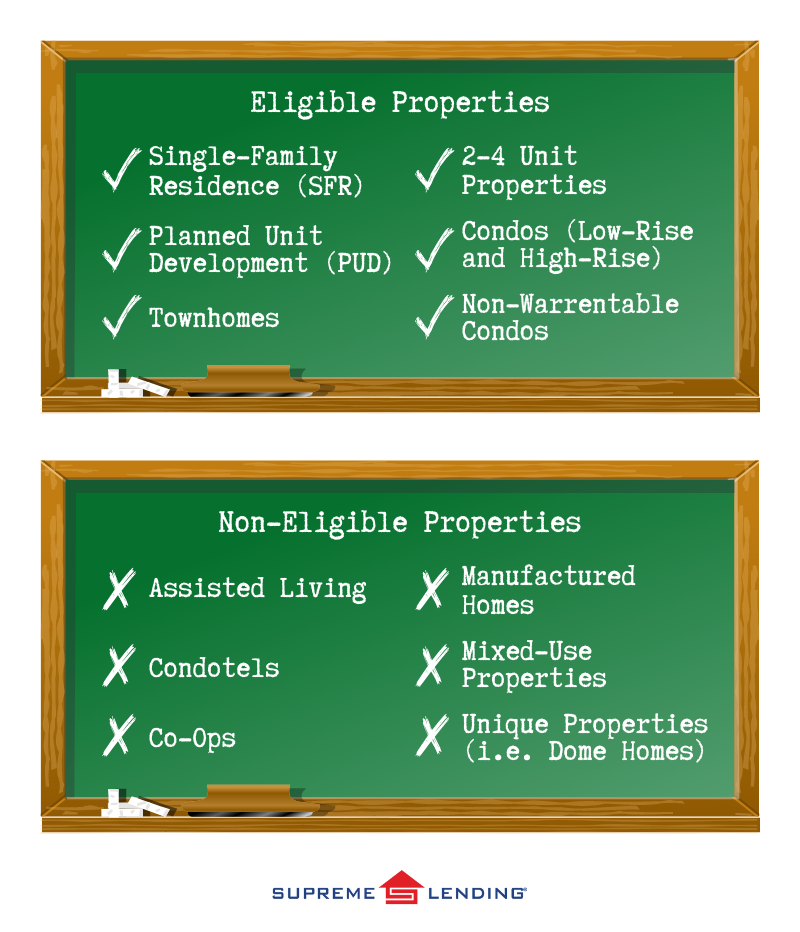

While guidelines to qualify for DSCR loans vary by lender, here’s an overview of common program highlights of Supreme Lending’s DSCR offering.

- Eligible borrowers include both first-time and experienced investors, but first-time homebuyers do not qualify.

- Foreign Nationals can qualify if eligible.

- First-time investors allowed at 75% Loan-to-Value (LTV).

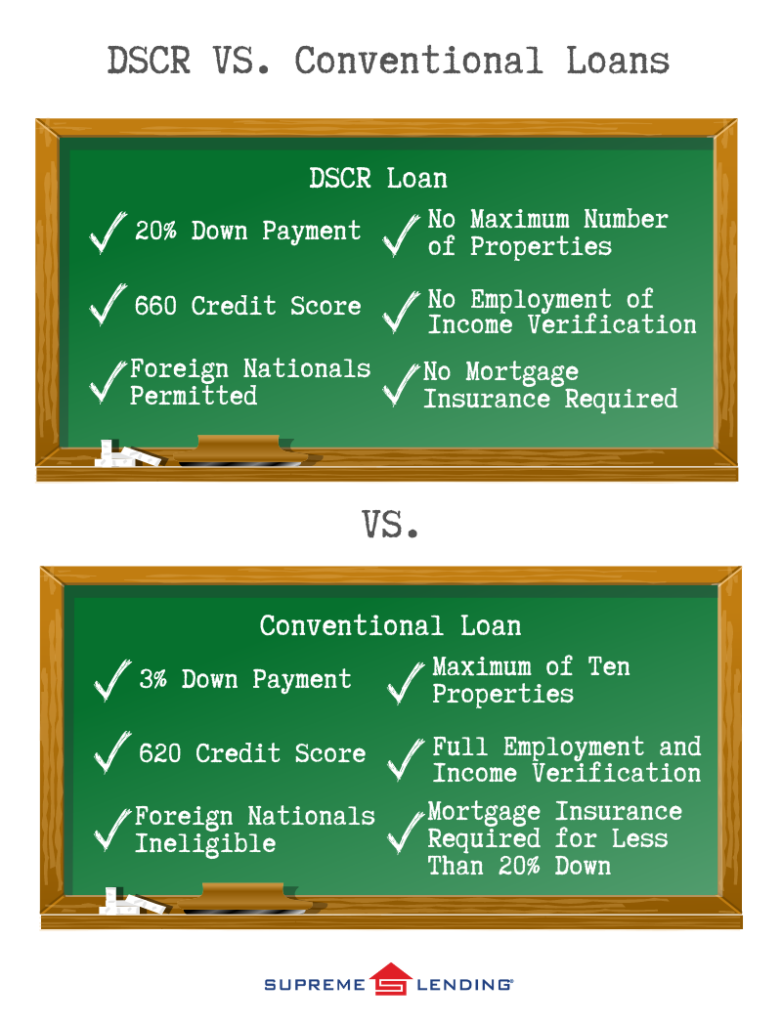

- 20% down payment required; 25% for first-time investors.

- Vesting in entities permitted such as partnerships or LLCs (Limited Liability Company).

- Purchase and refinance options available.

- Investment, income-producing properties only.

Why Choose a DSCR Loan?

Prospective borrowers for DSCR loans may be looking to take advantage of home investments and generate rental income. For example:

- Borrowers looking to start their real estate investment portfolio.

- Investors looking to expand their current real estate portfolio.

- Eligible Foreign Nationals looking for an investment opportunity in the U.S.

- Borrowers in an LLC looking to invest in a property with their business partner.

- Investors pursuing niche strategies like short-term rentals or the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) Method.

Benefits of DSCR Loans for Investors

- No documentation of income or employee verification versus conventional investment property loans, saving time and less documentation.

- No maximum number of properties—the sky is the limit!

- No mortgage insurance required compared to other loan options.

By evaluating a property’s ability to generate income relative to its debt obligations, DSCR loans provide valuable insights and savvy financing for investors—both first-time and seasoned investment professionals.

Contact your local Supreme Lending branch to learn more about DSCR loans and other mortgage options